2022 Federal Beer Excise Tax Calendar

2022 Federal Beer Excise Tax Calendar

In the case of small brewers such brewers are taxed at a rate of 350 per barrel on the first 60000 barrels domestically produced during a. The Tax Cuts and Jobs Act passed by Congress in December 2017 provided a temporary reduction in federal excise taxes for all brewers and beer importersCongress made these rates permanent at the end of 2020. 94529 reduced the excise tax on beer for small brewers to 7 per barrel on the first 60000 barrels produced in the United States and removed for sale or consumption or sale during the calendar year the reduced rate to be applicable only to brewers producing no more than 2 million barrels of beer in a calendar year and inserted provision that if several brewers are members of a controlled group the. - Monday April 19 no beer price changes.

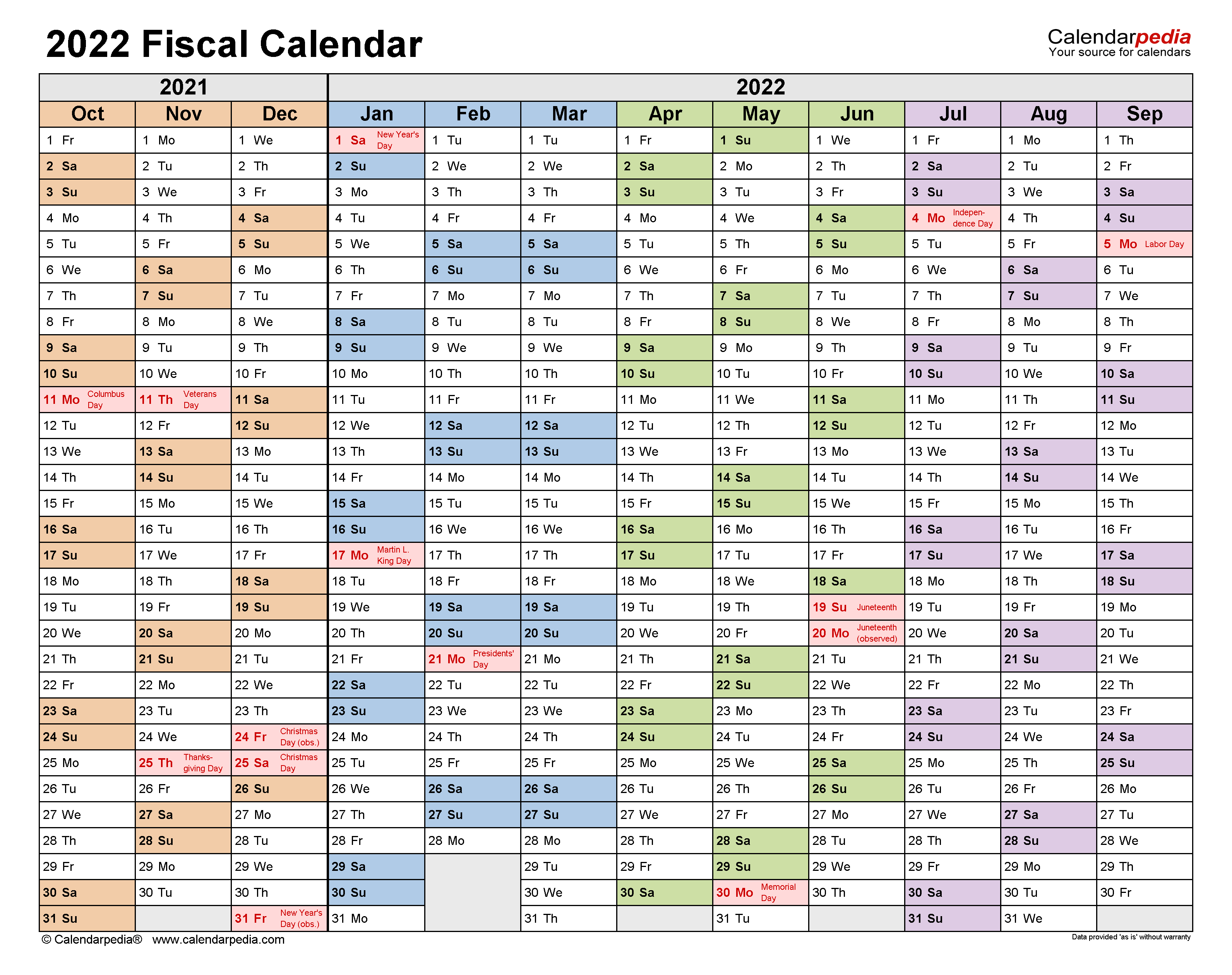

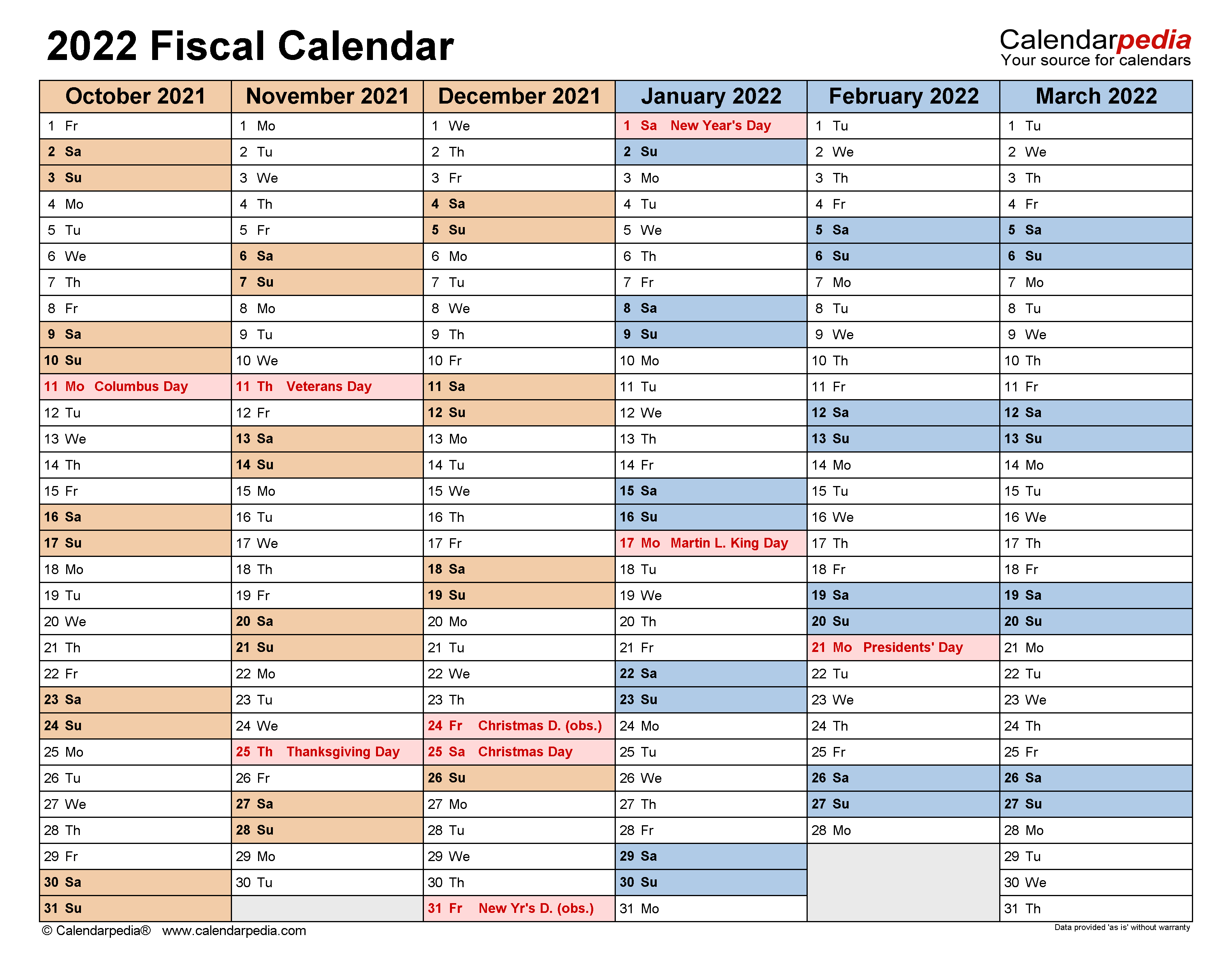

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

A holder of a federal basic permit to import distilled spirits issued by the Federal Alcohol and Tobacco Tax and Trade Bureau and a license to import distilled spirits issued by this state or any other state or a person licensed in any other state as a. - Tuesday April 6 Submissions and imported supplier quotes due by 4pm for April 26 change. July 1 September 30. Regular rates of excise duty on beer packaged in Canada.

Reminder - On April 1 2021 the Federal Excise Tax will increase based on the consumer price index.

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html2022 Federal Beer Excise Tax Calendar. Beer Canada calls on the government to roll-back the April 1 tax increase in the upcoming budget. The schedule is as follows. Beginning in 2022 processors must meet minimum processing.

Reduced tax rates on beer. Beer containing Effective April 1 2021 April 1 2020 to March 31 2021 April 1 2019 to March 31 2020 April 1 2018 to March 31 2019 March 23 2017 to March 31 2018. CALIFORNIA LEGISLATURE 20212022 REGULAR SESSION.

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

January 14 2022. 2200-C - Excise Tax on Invasive Cosmetic Procedures. Submissions accepted for May 3 retail effective. The Consolidated Appropriations Act 2021 CAA 2021 was passed by Congress and signed into law by the President on December 27 2020.

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

The first digital tax declaration will be submitted in January 2022 for the 2021 calendar year. The Minister of Finance signed an amendment to O. An act to. OTTAWA ON April 1 2021 CNW - Today the federal governments excise tax on beer has.

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

1620-XC - Final Withholding of Excise Tax on Invasive Cosmetic Procedures together with the assigned Alphanumeric Tax Code ATC of WI800 for individual and WC800 for corporate as prescribed under Revenue Memorandum Order No. The change in excise tax has no impact on the retail price as domestic beer is purchased excise paid If a change in price is desired please submit the Beer Price Submission form. Beginning in 2022 only DSPs who perform a processing activity other than bottling are entitled to take a CBMA reduced rate on distilled spirits that they process and remove. The PATH Act amendments to the IRC authorize a new annual tax return period.

Source: https://www.calendarlabs.com/2022-fiscal-calendar

Reduced tax rates on beer. Breweries that were registered with the FCA before 31 December 2020 and declare beer tax annually. 350 per barrel on the first 60000 barrels for domestic brewers producing fewer than two million barrels annually. Fiscal Calendar 2021-22 Forms DDVP.

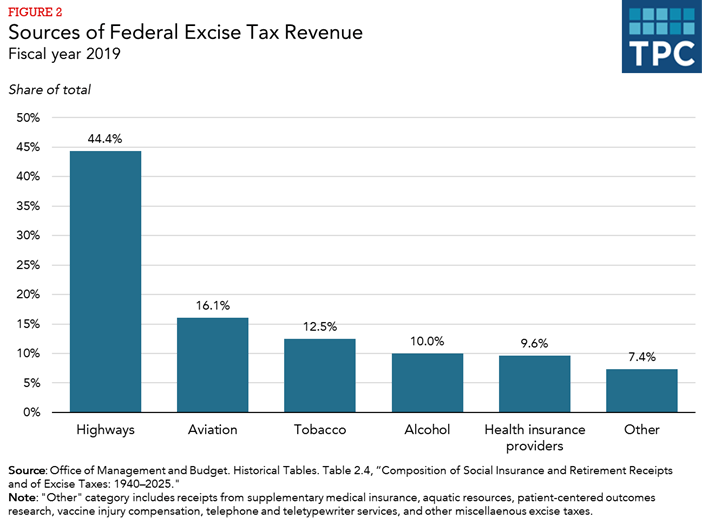

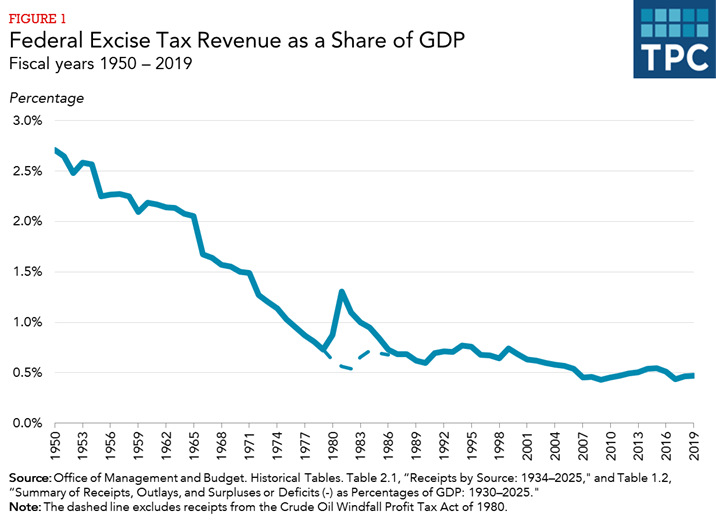

Source: https://www.taxpolicycenter.org/briefing-book/what-are-major-federal-excise-taxes-and-how-much-money-do-they-raise

The federal excise tax rates are now. Beer Canada calls on the government to roll-back the April 1 tax increase in the upcoming budget. 9-2018 dated January 4 2018 will be replaced with BIR Form No. CALIFORNIA LEGISLATURE 20212022 REGULAR SESSION.

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

Revenue Producing Plants Calendar Year 2021. Under current law eligible taxpayers who reasonably expect to be liable for not more than 50000 in taxes imposed with respect to distilled spirits wines and beer for the calendar year and who were liable for not more than 50000 in such taxes in the preceding. TTB Excise Tax and Export Due Dates 2021 Semi-Monthly Due Dates for Revenue Producing Plants. CAA 2021 includes federal tax law changes in a part of.

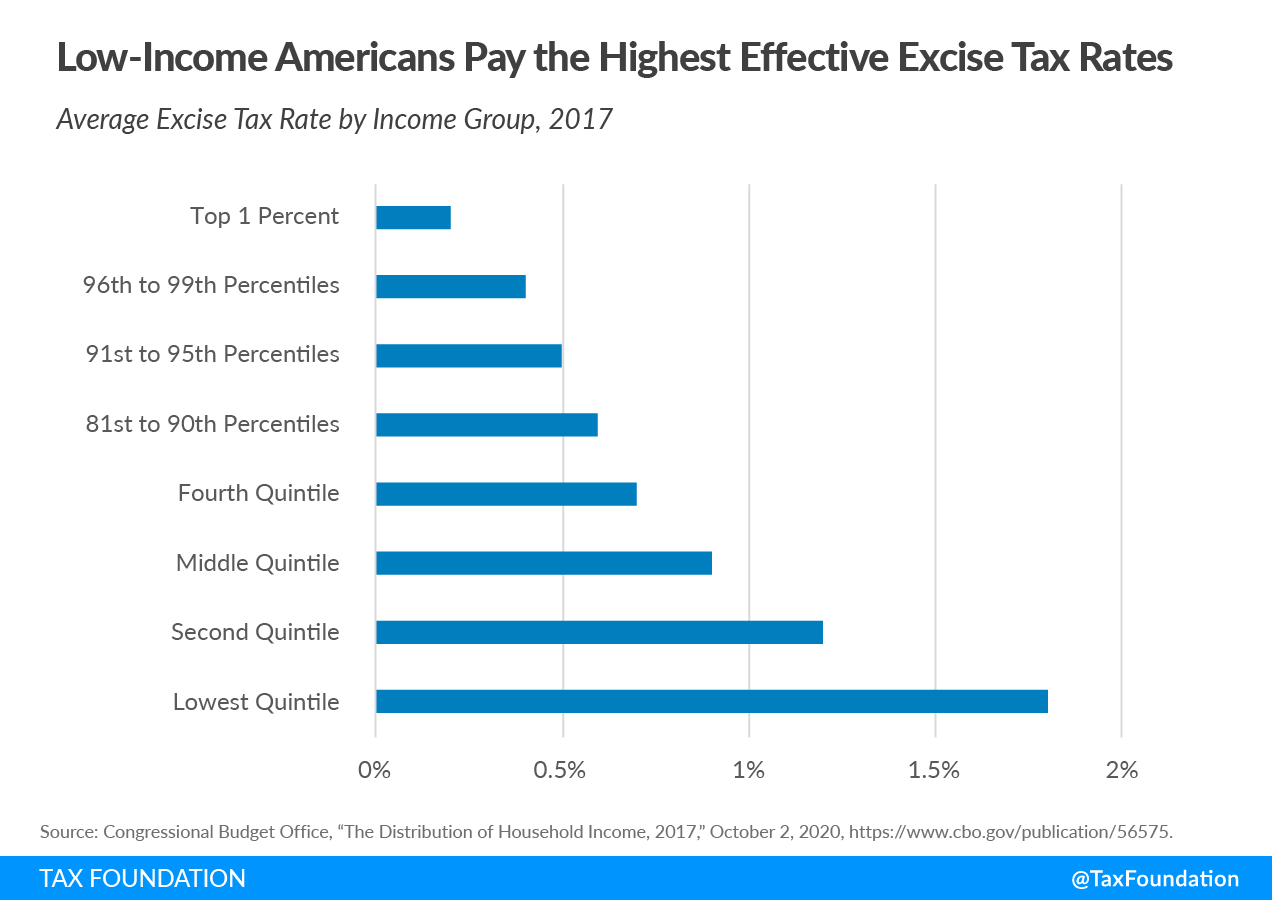

Source: https://taxfoundation.org/excise-taxes-excise-tax-trends/

The above list takes into. Accordingly the BIR Form No. Beginning in 2022 processors must meet minimum processing. Reg 25710 made under the Alcohol Cannabis and Gaming Regulation and Public Protection Act 1996 to delay the date of the next scheduled adjustment to March 1 2022.

Source: https://www.calendarpedia.com/fiscal-calendar-2022-pdf-templates.html

Not more than 12 of absolute ethyl alcohol by volume rate per hectolitre 2822. Beer produced and removed by a domestic brewer who produces 2000000 barrels or less per calendar year. Introduced by Senator Allen. Excise tax rates were temporarily reduced for calendar years 2018 and 2019 with the CBMA provisions of the Tax Cuts and Jobs Act of 2017.

Source: https://www.taxpolicycenter.org/briefing-book/what-are-major-federal-excise-taxes-and-how-much-money-do-they-raise

Beginning with the calendar quarter starting January 1 2017 taxpayers who reasonably expect to be liable for not more than 1000 in taxes imposed with respect to distilled spirits wine and beer for the calendar year and who were liable for not more than 1000 in such taxes in the preceding calendar year may pay those. Wines and beer for the calendar year and must not have exceeded those liability limits in the preceding calendar year. The liability in the preceding calendar year is the taxpayers actual liability under the rates applicable. Beer brewed or imported in excess of the six-million-barrel limit continues to be taxed at 18 per barrel.

Post a Comment for "2022 Federal Beer Excise Tax Calendar"